For most new vaping converts, choosing the right amount of nicotine in your e-liquid is a tough choice, right up there with figuring out what kind of hardware you're going to use and what flavors yo …

Breazy Vape Blog

"Does nicotine make you tired?" is a question that many people have asked, and the answer is that it doesn’t. It tends to disrupt sleep patterns and make you more likely to sleep for fewer ho …

E-Liquid Ingredients Hello again, dear readers. Today we're going to tackle a topic that's been the subject of mountains of speculation but very little substantial debate – what actually go …

Buying a Vape Pen: Ultimate Guide It may be quite daunting to see the wide selection of vape pens available if you're new to vaping. Whether you see a simple slim one button pen or a multi-la …

Choosing The Best Vape TankOne of the most important parts of vaping is choosing the right tank. It’s critical because you’re not only searching for the best vape tech, but also something that’ll suit …

Batteries are a critical component of every vaper's hardware, whether you know it or not. Simply put, they provide the power needed to vaporize your e-liquid: no power, no vapor. If you’ve got …

To Ohm, or to Sub Ohm: That is the Question …that many new vapers are confronted with when selecting the tank and mod to get started with. Let's explore. Plus-Ohm Vaping Yo …

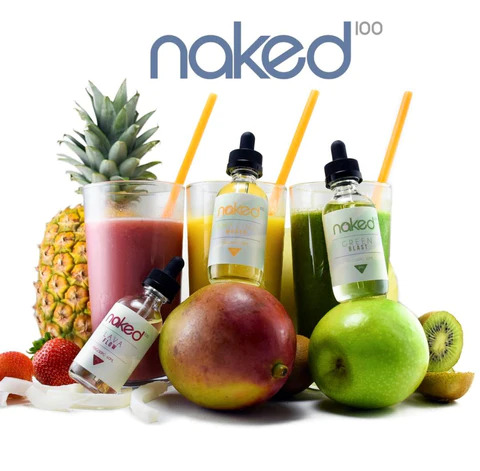

When it comes to vaping, choosing the right vape juice brand is crucial to ensuring an enjoyable and satisfying experience. With so many options available on the market, it can be overwhelming to deci …

Vaping is a hobby revolving around quickly evolving technology, one that's created an entire subculture that started online but has since spilled forth into brick-and-mortar vape shops across the coun …

Pod mods are compact e-cigarettes that store e-liquid that in a self-contained pod. They are compact, easy to use and inconspicuous. There are two types of pod mods: Closed and Open System. Close …