For most new vaping converts, choosing the right amount of nicotine in your e-liquid is a tough choice, right up there with figuring out what kind of hardware you're going to use and what …

Breazy Vape Blog

"Does nicotine make you tired?" is a question that many people have asked, and the answer is that it doesn’t. It tends to disrupt sleep patterns and make you more likely to sleep for fewer hours du …

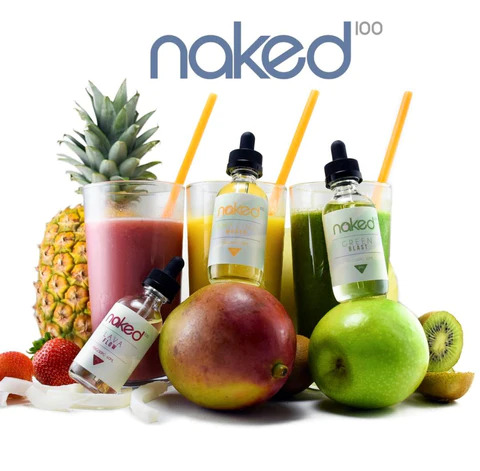

E-liquid is an important component of any vaper’s kit. Super-premium juices can also be quite pricey, so knowing how to get the most shelf life out of your e-liquid can come in handy if you’re on a …

The modern version of disposable e cigarettes was invented by Hon Lik as an alternative to traditional combustible cigarettes. The idea was to create a more discrete way of consuming nicotine withou …

Nicotine is an essential part of vapor products - if you're a former smoker it's the reason you were drawn to vaping in the first place, after all. A sweeping trend that has increasingly taken over …

We know. The world of vaping be overwhelming. So many of products, so many flavors, so much jargon. And lots and lots of choices. Sometimes it can feel like too much. The first question to ask is …

Nicotine is a common ingredient in vapor e-liquids, and salt-based nicotine is the latest development to take the vaping industry by storm. Over the last year, salt nicotine or more simply “nic salt …

So, the time has come. You're ready to start vaping. By now, you've had a chance to educate yourself, weigh the pros and cons, and decided that switching to vapor products is the way to go. Still …

The time has come. If you've decided that yes, vaping sounds like the right choice for your situation, and you want to get started, it’s time for a starter kit. Great! But still, you may be thinking …

Hello there, budding vapers! Today, we’re going to discuss one of the vape community’s most popular products for newbies and vape veterans alike. We’re talking about...pods. We aren’t talking abou …